By Gregg Brown, Senior Director, Global Digital Products, Encompass Digital Media

“Those who cannot learn from history are doomed to repeat it.” George Santayana

Throughout history, technology has been transformative, not only in the way we obtain information but how we distribute it as well. Recent decades have seen technological advances that have revolutionized the music industry and its distribution channels. History has a strange habit of repeating itself and technological evolutions, such as Virtual Multi-Video Programming Distributors (vMVPD) and video consumption, are now disrupting the TV industry. There’s a lot that the TV industry can learn from the music industry’s transformation.

The Evolution of Music Consumption

As with other technological evolutions, consumers dictate the way ahead. In the music industry, consumers led the transition from analog to digital in the 80s, mobile in the 90s, to the eventual cloud-based services of today. Consumers’ insatiable appetite for music drove the creation of (albeit initially illegal) platforms, signaling to record labels and content aggregators that they wanted to listen to music via newer, easier to use mediums like computers and smartphones.

Only consumers didn’t want to pay for entire albums simply to listen to a few songs. Steve Jobs took heed, realizing that consumers only wanted to pay for what they listened to. As a result, Apple began licensing music content, affecting a paradigm shift in the market with iTunes selling music a la carte.

The resulting business model, revered by consumers, means that music lovers can access music by the song rather than by the album and more recently, via subscription-based services anywhere, any time.

Parallel Paths in the TV Industry

Today, a similar transition is happening in the video distribution market. Consumers initially demanded a new way to watch video on demand (VOD) content beyond their TVs on phones and tablets. Netflix came to the rescue, exposing market demand for the consumption of discrete video content whenever and however the consumer desired it. As with the music industry, this isn’t the end of the evolution. Consumers are now questioning the value of their cable subscriptions as they are only watching a fraction of the 800+ channels in their package. Cue the evolution of the skinny bundle (or ‘mesomorph bundle,’ as coined by Alan Wolk of Forbes) and live event streaming.

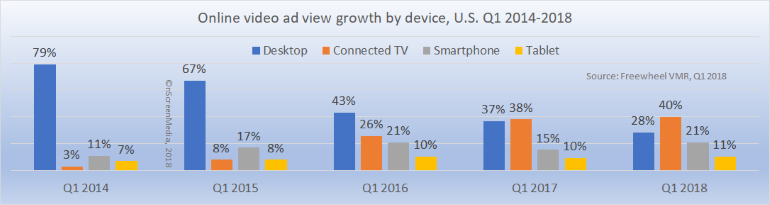

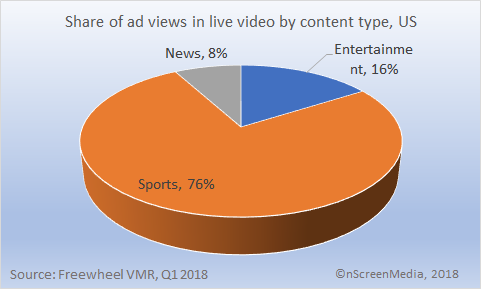

According to the Q1 FreeWheel Video Monetization Report, video views grew overall 35% from 2017 to 2018. The largest jump was seen in the live video category, with a growth rate of 77% from 2017 to 2018. This was mainly driven by the rise of vMVPDs, live sports and other event viewing.

The Impact on TV Content Providers

Today, content providers recognize that they’re losing the fight to apply pre-existing business models to the new ecosystem because it applies cost pressure on the aggregators, and they’re the gateway to the content. However, content providers also see a new opportunity to connect directly with consumers via alternative distribution channels such as vMVPDs.

The TV Distributor Shake-Up

The new vMVPD ecosystem is causing a stir with traditional distributors. On one hand, incumbent providers want to protect existing business while experimenting with new business models that appeal to more customer types. This is challenging, however, because they have existing investments in infrastructure, and it’s too early to tell if the vMVPD business model will be profitable.

New market players, on the other hand, are more optimistic and able to take greater risks, because they can rely on more flexible, scalable and future-proof infrastructures to distribute content. Similar to Napster, iTunes, Pandora and Spotify in the music space, Netflix, Amazon, Hulu, Sling, PlayStation Vue and DirecTV Now lead the video space. These few are defining the market landscape for the future.

What About the Aggregators?

Aggregators are the gateway between content owners and consumers and have typically been the innovators of new business models. Netflix and Amazon Prime are the de facto frontrunners for SVOD services while Sling and YouTube are the most notable vMVPD providers.

Yet to be determined is a pure play, ad-supported video service. These services offer more opportunity for niche and regional aggregators as the content variety can vary so widely.

The market will only bear one or two winners for each business model. Below are 2017 subscriber numbers for the vMVPD market as estimated by The Diffusion Group. Most forecasters are expecting them to almost double by the end of 2018.

| Provider | Year-end 2017 Subscriber Estimates (millions) | Percentage of Mix |

| Sling TV | 2.3 | 43.40% |

| DirecTV Now | 1.2 | 22.64% |

| PlayStation Vue | 0.6 | 11.32% |

| Hulu with Live TV | 0.45 | 8.49% |

| YouTube TV | 0.3 | 5.66% |

| fuboTV | .15 | 2.83% |

| Philo | 0.05 | 0.94% |

| Other | 0.25 | 4.72% |

Final Pieces of the Puzzle

Back when the iPod launched in 2001, there were already other mp3 players in the market. Can you remember any of them? Exactly. Apple didn’t just create the option for consuming music; they defined an entirely new business model of which the iPod was a key component.

Another major component was licensing and providing access to the music. Some may say that when the iPhone launched in 2007, it became the single greatest catalyst to converge mobile and music into what exists today. Others believe that Apple saw an opportunity and began laying the foundation with the iPod all the way back in 2001.

We’re witnessing a similar trend today in the video industry. Mobile video consumption relies on two major components: devices to watch the content and the network delivering the content. Each plays a huge role in taking the market from nascent to mainstream.

Devices Get All the Love

For devices, the comparable transition to multi-screen video was initiated by the iPad. Even though the Connected TV has surpassed it in usage today, it was the tablet with its bigger screen, connectivity and mobility that made consumers realize what was possible for consuming movies, events or shows outside of traditional TV.

The Network is the Unsung Hero

While devices have all the sizzle and appeal that drive media consumption, it’s the network (mobile, Wi-Fi, CDNs and ISP) doing all of the heavy-lifting to make it happen. That’s what’s continuing to help evolve business models to where the market is today.

For example, streaming music services like Spotify and Pandora represent a growing portion of the market vs. download and go. Their success can be attributed to networks that have improved so much that consumers can have a near flawless experience listening to streaming content without the need to be tethered to their downloads.

On the video side, we’re in the early stages of network improvements that will enable the complete TV experience across both large and small screen devices. What does that mean? The IP network can now handle large-scale sporting and cultural events, allowing users to watch these live events across their device portfolio without having to be tied to their cable system. This is the ‘Holy Grail’ that will finally enable the vMVPDs to thrive.

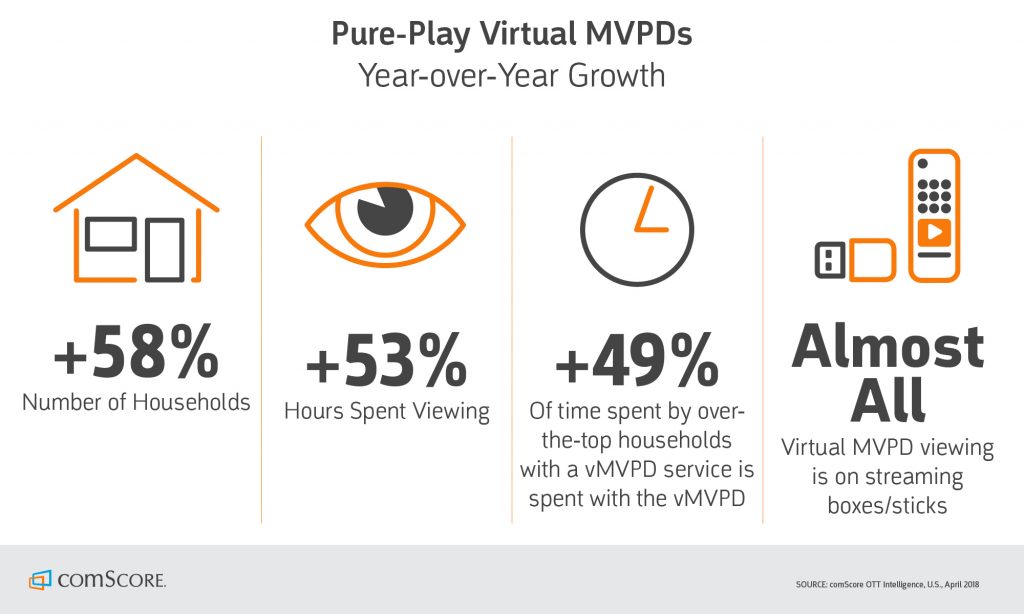

As noted by nScreenMedia and comScore, below are viewing statistics that validate how this collision of the network, device, content and business model are enabling live events to drive usage on vMVPD services. This further validates that vMVPDs will be increasing consumer eyeballs in the future.

How is All of This Relevant to Me?

As the technology battles among devices, network, consumer experience and business models continue to evolve, there’s much the TV industry can learn from the music industry’s transformation. Whether you are a content provider or content aggregator, you need a trusted advisor that can help you navigate the landscape and allow you to do what you do best. If you are a content provider, focus on creating great content and distribution partners. And, if you are a vMVPD, create bundled experiences and deliver an excellent user experience to your customers. Let a company like Encompass handle all the dirty work in between.

Encompass Digital Media is a market leader in the ability to capture, process and deliver video content anywhere, to any device on the planet. We provide managed services to 1,200+ channels, stream 6,500 hours of content daily, across nine facilities on four continents. Contact us today to learn how our solutions benefit content providers and vMVPDs.